The Case for R in Finance

Balancing the Scales with Python

By Adam Bozman in Theme Features R

January 2, 2024

Introduction: The Strategic Role of Python and R in Finance

In the dynamic world of finance, the tools we use critically shape how we analyze data, forecast trends, and make pivotal decisions. The ongoing debate between Python and R transcends mere technical preferences, representing a strategic choice with significant implications for the industry. While Python enjoys widespread popularity, R’s robust capabilities, particularly in academia and research-oriented finance, warrant equal recognition. This analysis aims to explore the roles and merits of both Python and R, providing a balanced and detailed perspective in the context of financial applications.

Evolution of Programming and Big Data in Finance

The finance industry’s journey began with languages like COBOL and Fortran, focusing on efficient numerical calculations. Some of the derivatives of these command-driven languages (e.g., SAS & Stata) still maintain their popularity, today. However, the late 20th century witnessed a shift towards more versatile languages. Python emerged as a frontrunner, thanks to its straightforward syntax, a vast array of libraries, and flexibility, catering to various financial applications like data analysis and machine learning. Simultaneously, R, deeply rooted in statistical analysis and data visualization, became a staple in academia, designed by statisticians for detailed analytical work. What’s most interesting, however, is how these languages have evolved to complement each other, rather than compete. Despite this complementation, R has been figuratively crucified in academic research.

That is, R has been considered taboo in my own research training, but this does not appear to be a unique experience. While the canned-equations and institutional support of SAS still seem to be a crutch for academics actively conducting research, Python has carved out a youthful niche. This begs the question, why not R? R has many diverse applications beyond just statistical analysis. For instance, this website is build using R, knitted to HTML, and hosted through GitHub. This is a testament to the versatility of R, and the fact that it is not just a statistical language.

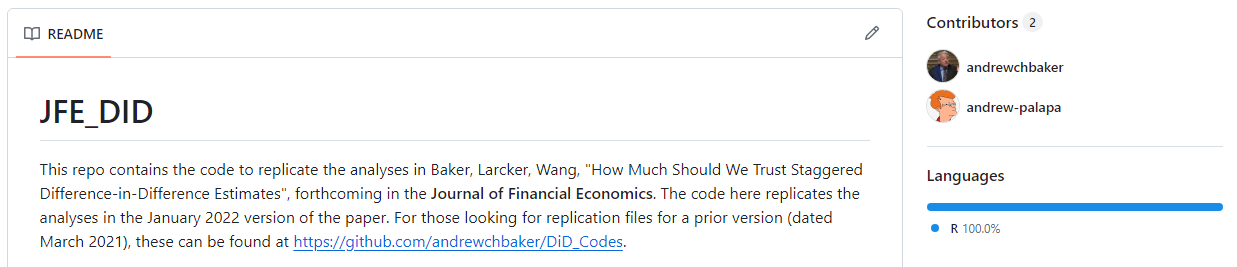

The finance industry’s increasing reliance on big data and machine learning has created a need for a more holistic approach, utilizing both Python and R - evident by the incredibly fast growth of data sciene and quantitative teams in firms. Python’s general-purpose nature complements R’s statistical depth, providing a comprehensive framework for financial analysis. This approach ensures robustness in financial models and strategies, enabling professionals to transition seamlessly from theoretical research to practical application, fostering innovation and ensuring the integrity of financial analyses. In some circumstances, analyses can only be performed in R (at least initially). An easy example of this was the recent tier 1 publication from our friends at UC Berkely, “How Much Should We Trust Staggered Difference-in-Difference” (Baker, Larcker, and Wang, 2020). Thanks to the pedigree of Dr. Baker and his co-authors, this paper was published in the Journal of Financial Economics, one of the top three finance journals. Without such noteriety, I fear a paper of this consequence may have been rejected due to its emperical approach.

Python vs. R: A Dual Perspective

Python is celebrated for its adaptability, managing diverse tasks such as algorithmic trading, risk management, and machine learning, supported by libraries like Pandas, NumPy, and Scikit-Learn. R, on the other hand, is renowned for its statistical modeling and hypothesis testing capabilities, crucial for financial research and strategy development. R’s proficiency in data visualization, through packages like ggplot2 and Plotly, and its advancements in computing and integration with big data technologies, address its earlier limitations in handling large datasets.

Industry-Specific Preferences

R’s rise in the finance industry can be partly attributed to advancements made by Posit (formerly RStudio), which have significantly improved the R programming experience. Posit has been instrumental in developing a more efficient and user-friendly Integrated Development Environment (IDE) for R. These advancements include:

-

Enhanced User Interface: Posit has focused on creating a more intuitive and accessible user interface. This includes features like tabbed source windows, a more effective file explorer, and an integrated workspace viewer, which have made working with R more manageable, especially for beginners.

-

Integrated Tools for Data Science: Posit has incorporated various tools that are specifically useful for data science. This includes easy integration with version control systems like Git, support for Markdown and LaTeX for dynamic report generation, and tools for creating interactive web applications with Shiny.

-

Support for Big Data and Cloud Computing: Posit has expanded R’s capabilities in handling big data and cloud computing. This is crucial in finance, where large datasets are common. Their tools now allow seamless integration with big data platforms and cloud-based services, enhancing R’s scalability and performance in financial applications.

Python’s Regulation

The perception that Python libraries are somehow better regulated and maintained than R libraries is, anecdotally, given as logic against R’s integration in finance. However, this does not fully capture the dynamics and nuances of library development and maintenance in both languages.

Creating libraries in Python is indeed straightforward. This ease of creation has led to a vast ecosystem of Python libraries. The Python Package Index (PyPI) hosts these libraries, and the community actively maintains many of them. Python’s popularity and the size of its community contribute to the rapid development and frequent updates of these libraries.

Similarly, in R, the process of creating and publishing packages (R’s term for libraries) is also well-established. The Comprehensive R Archive Network (CRAN) is the primary repository for R packages. CRAN has a rigorous submission process that ensures packages meet specific standards for quality and documentation. This process includes checks for coding standards, documentation quality, and compatibility with different operating systems.

Bridging the Gap: Harnessing the Combined Power of Python and R in Finance

The symbiosis of Python’s versatility with R’s specialized statistical prowess offers a robust solution for financial modeling and strategic planning. This dual-language approach not only facilitates a seamless transition from theoretical research to practical implementation but also fosters innovation and upholds the integrity of financial analysis.

Python and R are far from being mutually exclusive; their integration forms a formidable alliance in the realm of data science and statistical analysis. R’s reticulate package plays a pivotal role in this union, allowing Python code to be executed within an R environment. This capability enables a fluid interaction between the two languages, making it possible to run Python scripts, invoke Python functions, and interchange data structures—like transforming R data frames into Python Pandas data frames.

Conversely, Python’s rpy2 library provides a reciprocal pathway to R, enabling the incorporation of R’s sophisticated statistical and graphical functionalities directly within Python scripts. Furthermore, Jupyter Notebooks’ compatibility with both Python and R kernels facilitates a versatile coding environment. In this integrative setup, Python and R can be leveraged simultaneously, significantly enriching the research and exploratory data analysis processes.

The Case for R in Finance

-

Statistical Modeling and Data Visualization: R’s core is built for statistical analysis. Its comprehensive package ecosystem, including ggplot2 and Plotly, offers unparalleled data visualization capabilities, making it indispensable for complex financial analysis and research.

-

Memory Management and Data Handling: Critics often point to R’s limitations in handling large datasets. However, advancements in computing power and integration with big data technologies like Hadoop have significantly mitigated these concerns. R’s capacity for handling complex data structures is increasingly relevant in finance.

-

Security and Deployment: While R is often criticized for security concerns, particularly in web environments, recent developments in virtual container technologies have alleviated these issues. Moreover, in finance and research settings, R’s application often occurs in secure, controlled environments, diminishing the impact of such concerns.

-

Academic Contributions: R’s prominence in financial textbooks underscores its effectiveness in finance education and research. It serves as the only language addition to a common textbook that I use in my Financial Modeling classes, something Python has yet to accomplish.

Conclusion

As the financial industry evolves at the intersection of technological advancements and complex modeling, the significance of the tools we use intensifies. Python and R, each with their distinct strengths, collectively provide a comprehensive framework for financial analysis. What has been emphasize already is the likeness of these two languages. Embracing R alongside Python is not just about acknowledging its contributions; it’s about enriching the finance industry with diverse, robust, and innovative methodologies - I encourage fellow academics in my field to recognize the value and similarity available using both Python and R. In this era of data-driven finance, both Python and R stand as essential tools, supporting and advancing the field in unique and complementary ways.